Certain loan providers render ninety% so you’re able to 95% LTV HELOCs, but once more, such higher maximums go along with dangers, eg being under water on your domestic or overwhelmed by highest monthly premiums. Listed below are some loan providers giving large LTV HELOCs and home security loans:

Do you really score a great 100% LTV HELOC?

You might be eligible for a beneficial 100% LTV HELOC regarding Navy Government Borrowing from the bank Connection, regardless of if a keen LTV restrict which higher is quite rare. Still, additional borrowing from the bank unions give this package:

As this is your house-most of your place for security-it makes me afraid when people more-leverage by themselves to the stage where they can not protection the expense. You are able to afford the payment into an excellent HELOC now, although not, having a changeable rate of interest, this fee can conform to a point where it’s stretched affordable. When you take aside any obligations, I stand by 31%, meaning your overall obligations payments should not meet or exceed 30% of your own gross income.

How exactly to enhance your household guarantee

If you’d like to enhance your domestic equity to sooner qualify to possess a larger HELOC or home equity loan, this type of procedures can help you to obtain your goal.

- Make bi-per week mortgage payments

- Put extra into the your financial prominent each month

- Incorporate one windfalls with the home loan prominent

- Wait for the housing marketplace to help you move before applying

- Repair otherwise replace your house

Just how to apply for a HELOC or domestic equity financing

If you’ve made a decision to proceed that have good HELOC or family guarantee mortgage, is particular insight into the general techniques:

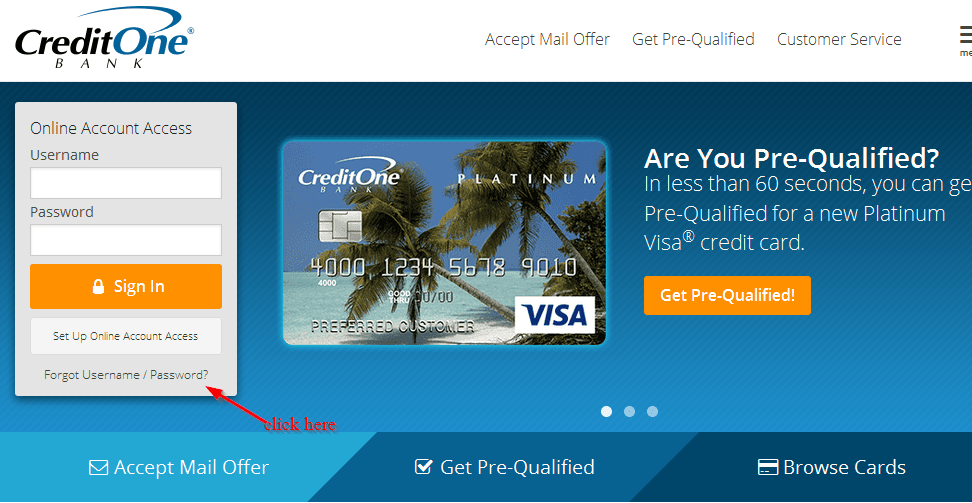

- emergency cash for single mothers

- Compare loan providers and you can HELOC choices

- Collect essential private and you may financial files, also W-2s, taxation statements, financial comments, spend stubs, plus.

- Apply for an effective HELOC on the internet, over the telephone, or perhaps in person

- Give even more files, whether your lender needs them, and you may watch for approval

What else has an effect on my HELOC qualification?

Your financial will envision several affairs past LTV and you can CLTV ratios to determine for folks who qualify for a HELOC. This is what they likely opinion after you incorporate.

Typically, loan providers as well as purchase an appraisal to assist determine industry value of your house. The newest assessment processes can differ from the bank, which includes requiring an out in-people appraisal while others performing appraisals on line. Your own residence’s market price can assist dictate the total guarantee.

Options in order to house equity loans and HELOCs

Without having adequate security of your house otherwise are nevertheless exploring your options, thought options to help you house equity financing and you can HELOCs.

Unsecured loans

A consumer loan is actually a predetermined-price fees mortgage off a lender, borrowing from the bank partnership, or on the internet bank. You can utilize a personal bank loan for any purpose, as well as debt consolidating, renovations, or issues.

These types of loans are often unsecured, definition that you do not chance dropping your residence or even make costs. Although not, a possible drawback is that mediocre unsecured loan pricing are higher than house security mortgage costs.

Credit cards

Handmade cards resemble HELOCs since you may borrow secured on a personal line of credit as needed. Unlike HELOCs, although not, it’s not necessary to shell out closing costs or exposure equity when you look at the your residence.

But not, playing cards typically have highest pricing than household security funds and you will HELOCs. If you don’t shell out your own mastercard equilibrium entirely to the otherwise before due date, you could are obligated to pay a lot of money into the desire.

Certain credit cards bring a great 0% basic Apr getting an appartment time frame, though. That it marketing and advertising Apr will enforce to possess several or eighteen months, enabling you to spread your repayments over time. A cards like this might possibly be worth considering if you need to invest in a smaller sized bills; simply always can also be pay-off what you owe before advertising period comes to an end.

]]>Forty-about three per cent out of last year’s home buyers utilized something special out of members of the family otherwise family relations to help with their downpayment, many once the at the least 2018

- A median-money household would have to lay thirty-five.4% as a result of afford the costs into a frequent You.S. home.

- Five years back, an average U.S. home would have been affordable so you can an average-earnings family with no money down.

- A normal house is sensible in order to a median-earnings domestic having 20% off otherwise less when you look at the 10 of the 50 greatest You.S. areas.

S. household, property buyer making the average earnings needs to lay out nearly $127,750 , or 35.4%, a new Zillow data reveals. Five years ago, when home loan cost was indeed hanging merely above cuatro% and the normal family try worth from the 50% smaller, you to family could have been affordable without money down.

You to $127,750 advance payment is exactly what a household deciding to make the median income will have to set out when buying a frequent U. 1

The enormous gap between the down payment needed now and five years ago underscores how the pandemic fueled a scorching-hot housing market, and why the rise in financial cost in the time since has cooled the market. Stubbornly high mortgage rates have pushed both buyers and sellers to the sidelines. With so pair virginia homes, race try stiff among the remaining buyers.

“Off repayments am important, however, significantly more very now. With so partners offered, customers may have to waiting also expanded for the right family going to the market, specifically given that consumers can afford shorter. Mortgage rate moves in those days will make the essential difference between affording one domestic and never,” said Skylar Olsen , captain economist on Zillow. “Rescuing enough try a large task rather than external assist – a gift of friends or at least a stock windfall. To make the cash performs, some folks are making a big transit the world, co-to acquire or to order a home that have a supplementary place in order to lease aside. Down-payment assistance is another great investment that’s too often missed.”

To save up $127,750 , it would take a household making the median income about 12 years (assuming its members save 10% of their income each month with a 4% annual return). It’s no wonder then that 43% out of history year’s consumers used a gift from family or friends for at least part of their down payment, the highest share since at least 2018.

You can still find affordable pouches of your own You.S. From inside the ten biggest towns, an average residence is reasonable in order to a median-earnings house having below 20% down. Pittsburgh boasts the least expensive housing marketplace. A median-earnings house there may spend the money for monthly installments on a normal domestic despite no money off.

Within the Los angeles , an average-income home would need an enthusiastic 81

California is on the other end of the affordability spectrum. A median-income household in San Jose would need to put down more than $1.3 million to afford the mortgage payments on a typical home – that’s more than the typical home is worth in every other major market. 1% down payment ($780,203) to afford the typical home, the highest in the country. This helps explain why many California metros have seen society losings since 2020, as long-range movers target areas with more affordable housing.

In the event you be considered, deposit guidance can also be enhance offers and help a purchaser enter into homeownership easier. During the Minneapolis , eg, an average quantity of down-payment assistance available along side urban area is around $twenty-two,750 , predicated on studies out of Downpayment Financing. An average-money consumer for the Minneapolis versus downpayment guidance will want good 27% down-payment to easily pay the normal domestic. Having $twenty-two,750 within the downpayment direction, they might need to set 21% down.

S. home – cherished at about $360,000 – therefore, the monthly mortgage repayments occupy no more than 30% of these household’s monthly money

“Homeownership is the first source of websites value and generational wealth for some People in the us, and you may declining cost try making it more difficult to possess average earners to obtain foot in the door of an entry-top household. Fortunately, there are many than just 2,373 down-payment advice applications nationwide which have one or more system in almost any state and you will ten or more applications obtainable in dos,000 counties,” said Down payment Resource Originator and you may Ceo Rob Chrane . “Actually, https://paydayloancolorado.net/southern-ute/ downpayment assistance team provides responded to the hard houses s considering and broadening index selection that have support for are made property and you will owner-occupied multiple-equipment property.”

]]>- Do i need to pay back my personal Fifth Third Bank physician loan very early in place of a punishment?

Sure, 5th 3rd Financial doesn’t charges an effective prepayment punishment, providing you with the flexibility to repay the loan early instead most will cost you.

- Do you know the certain credit rating criteria?

- Generally, a credit rating of at least 720 is required to have an excellent Fifth Third Financial doctor mortgage to make sure qualifications for the best cost and you will terms.

Once you’ve safeguarded your medical professional financing out-of 5th 3rd Bank, handling they efficiently is a must for long-name financial health. Below are a few solutions to help you control your mortgage sensibly:

step 1. Budget Intelligently

Keeping a solid finances is essential. Include their home loan repayments and you may people relevant expenses, such as for example assets taxes and you will home insurance, on your monthly budget. Ensure that you make up the chance of ascending rates if you’ve chosen an adjustable-speed mortgage (ARM).

dos. Build an emergency Money

Unanticipated events make a difference to your ability while making timely home loan repayments. An emergency financing level no less than three to six months out of living expenses, including your financial, also provide a safety net throughout the economic uncertainties.

step 3. Believe A lot more Costs

In the event your financial predicament lets, making even more costs for the your own home loan dominating can lessen the overall focus you have to pay along the life of the borrowed funds and you will probably shorten the loan term.

4. Sit Informed On the Refinancing Solutions

Be mindful of rate of interest style. When the cost shed notably, refinancing your physician financing you may lower your monthly premiums otherwise succeed you to option out-of a changeable so you’re able to a predetermined-speed mortgage, getting so much more foreseeable economic considered.

5. Consult with Financial Advisers

On a regular basis seeing a monetary coach helps you create told behavior regarding the home loan from inside the context with your greater financial specifications, for example senior years thought and you may resource procedures. While simply starting plus don’t possess a monetary advisor we recommend sitting down and you can think away what your next step 3-5-7 age look like while in residence.

Long-Term Planning Together with your Doctor Mortgage

Investing a property because of a doctor mortgage is not only regarding the shopping for a spot to live; additionally it is a strategic economic disperse. Since your occupation moves on along with your income develops, you really have most chances to power the property’s security for after that financial benefits, eg committing to a lot more assets otherwise while making tall renovations.

Existence Proactive which have Loan Government

Effective handling of your physician loan is a must. On a regular basis review the loan comments, remain on most readily useful of every alterations in fine print, and always become proactive from the calling your own bank for those who foresee people difficulties in making money. Effective interaction along with your lender can frequently offer choices to mitigate potential factors.

Leverage Your home to own Future Financial Balance

Your home is not simply an actual house; it is an important part of the monetary portfolio. As you build guarantee, you have got chances to utilize it to bolster your financial future, if or not owing to refinancing to better terminology otherwise playing with domestic equity outlines out of borrowing to other significant costs otherwise investments.

Safe Your following Today

Go on their happen to be homeownership with certainty. All of us of pro lenders specializes in physician mortgages that is here to guide you courtesy each step, guaranteeing you get the finest conditions to suit your unique demands. Extend now to understand more about exactly how a 5th Third Financial physician mortgage https://paydayloancolorado.net/pritchett/ would be section of your financial strategy, helping you secure not just a home, and a reliable and you may prosperous upcoming.

- Fifth 3rd Bank’s doctor mortgage interest rates are very competitive, remember regardless of if, this is exactly a portfolio tool. Lenders may come inside and out of the industry throughout the 12 months.

A lot of people enjoys sweet homes in medicine, genuine expensive properties, and you can they truly are expanding a lot. You get a million-and-a-half dollar household out of the blue. But what I’m trying to state is if everything else have perhaps not started expanding since you version of got a small overextended to the domestic, In my opinion it might be useful to consider you to definitely.

That is why it is advisable that you tune your web worthy of as exactly what takes place in one condition is if some thing lose their freshness, you’ve got much less push space in this situation. You can’t really need as frequently off a downturn. And you are not even capable save getting things like advancing years, training, travelling and people anything in life. There are more something in life and I know lots of you’ve got other places we should work at, but it is an individual decision.

Each person put a higher value to the having a nicer domestic. I’m not he that claims go on to a decreased cost off kitchen simply being spend less and you can attempt to help save when you can. I think you can find reasons to proceed to high cost of traditions areas including to someone and you may family members, if it is reasonable. That’s what this really is regarding. It is such as for example having the ability to fits this material with everything consider important.

I believe that is what very issues from inside the mans life

Doug: I simply talked in order to a health care provider a week ago. He was claiming a few of their family unit members from inside the Sodium Lake bought property having $350,000 5 years before, and perhaps they are offering them to have $900,000 at this time. And here you are going to buy the marketplace thereupon variety of come back, yet not this present year.

Daniel: People kinds of quantity generate me genuinely believe that there can be specific ripple taking place here. Very areas are not some. Salt Lake City has exploded gains-smart. It has been a hot field. In any event, would you see one short-term? I’m going to try to make you do an anticipate right here.

I just told you we are really not browsing generate forecasts, however, I’ll generate Doug make a prediction. Maybe not a forecast, exactly what is your current thoughts on in which everything is supposed from here? On credit industry, are you willing to see any style? I’m curious about your findings.

Doug: In advance of i started, we had been only kidding about it. I believe a specialist weatherman is correct 60% of the time, so I will preface my nerve here.

Doug: Turning the fresh new coin , you are best half of committed. I think pricing are likely to most likely consistently rise the fresh rest of in 2010, not at a pace one to we have seen seasons-to-go out given that I believe we’ve seen a large disperse. When you see prices rise yet another 75% regarding good part between now together with avoid of the season, I am throughout the go camping of it.

It’s simply given that possible that second summer costs is lower than just he could be at the conclusion of the entire year than simply they is highest. How come I think that can takes place try obtained doing anything, since the as we was in fact talking, Salt River or Austin, a number of the cost there went right up thirty five%, actually 40% into the a good year’s go out, something’s got to give. They got to place the brake system thereon.

I might become best 60% of time

That is going to happen on the Fed going for the. Once they do so, I think they’ll carry out acts so you can a point in which it is not a precise research, very these are typically likely so you can overshoot. That is where In my opinion there is certainly coequally as good as a go you to definitely as the rates are possibly higher after this season, I will find it getting that 2nd summer, they actually may have to come back and state, oh, we overdid it, and then we simply loan places Marvel should not freeze the business, so here, we will all the way down prices back off.

]]>Property is Residential

The home you’re thinking about must be a home in the place of a professional possessions. However, brand new Virtual assistant does allow you to buy property that’s partly utilized for team, however, only if the property is principally home-based. Also, your residence must be zoned for domestic have fun with and you will adhere to newest zoning formula to suit your urban area. Your house can be a single-nearest and dearest, standard, otherwise mobile home, also it need to be much of your household.

The explanation for it Virtual assistant specifications is the fact Va home loans are created to help pros and their family get. Pros can make use of other funds and you may offers geared toward veterans so you’re able to help them funds a business and you will location.

Performing Stamina

To satisfy Va approval MPR standards, the home you’re considering needs to have safe and functioning strength. This new electronic program home would be sufficient to power required appliances and lighting. However, your own appraiser is not required to show with the any equipment otherwise lights. Nonetheless, if wiring inside the a region of the home is understood not to be effective or perhaps is deemed unsafe, you or perhaps the seller might need to repair it until the Virtual assistant approves a loan.

No Unsealed Wiring

Together equivalent outlines, the newest Virtual assistant wouldn’t accept a home loan to own a property one to has established cables or unsafe electricity program features. The house should fall-in range with local strengthening codes, too, that could imply that the latest Va needs ensure that you reset keys to your all the GFCI channels or an upgraded circuit breaker from a fuse field. Frayed and you may apparent wires will need to be fixed no matter in which your home is discover.

Useful Cooling and heating System

Your own appraiser look to own adequate heat, particularly in areas where plumbing is available. The home heating system should be able to care for a fever from about fifty stages during the plumbing parts. New home’s coolant system must be when you look at the an excellent operating reputation which have zero signs and symptoms of harmful or unclean have. The brand new Virtual assistant also can accept solar heating and cooling if for example the domestic has a back-up cooling and heating program readily available.

Sufficient Roofing system

Most appraisers will consider the rooftop off a property certainly its essential elements. People current otherwise potential complications with a roof will be listed into the an assessment and you will property assessment.

The newest Va considers the brand new roof an essential part of one’s Va MPR record. Especially, your homes roof cannot have any most recent leaks or conditions that can lead to leakages, plus it must have at the least even more credible age out of lives remaining involved. Brand new Virtual assistant in addition to requires the removal of old shingles in case your house have at least about three levels off old shingles that need fix.

There are 2 towns and cities on the VA’s Lowest Possessions Conditions during the and this termites or any other damaging insects come into play having Virtual assistant capital qualifications. The appraisal report have a tendency to note people proof termites as a good bad condition you to influences the safety or hygiene of the house and in a section denoting timber-damaging insects, decompose, otherwise fungi.

Not absolutely all Va appraisals will need a solid wood-damaging check statement. When the a keen appraiser observes you’ll proof pests, the Va may need another type of evaluation. Property for the portion with modest so you’re able to big pest infestation probability may also need an insect or termite check getting Virtual assistant acceptance.

Correct Liquids and you can Practices

Your house demands more powering drinking water discover a good Virtual assistant financing acceptance. It ought to also have safer drinking water, warm water, and you will a continuous supply of powering liquids available for toilets, sinks, showers and you can baths, and you can ingesting. Your bathroom(s) must also get into a hygienic reputation.

]]>