News

Step four: Improve your borrowing

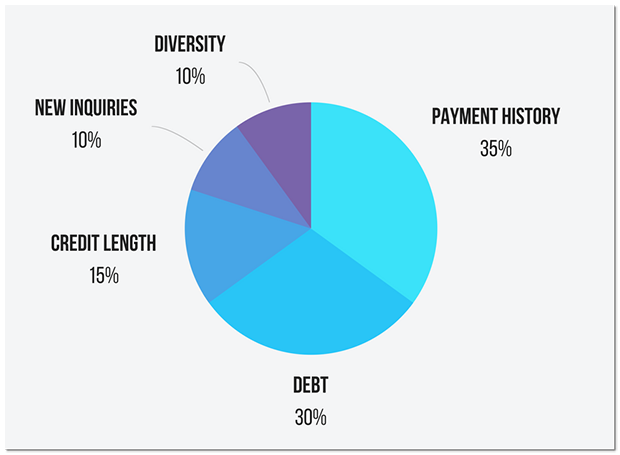

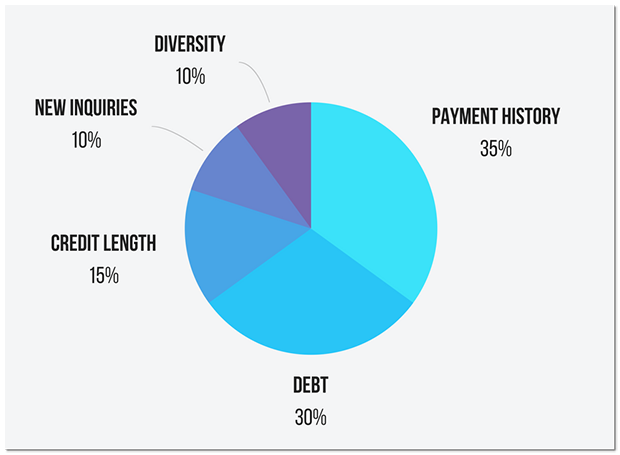

When you’re their motion has been processed, make use of this for you personally to focus on improving your credit rating. That it requires settling all of your current bills on time and you can refraining regarding using up any extra financial obligation. A high credit rating can make you more inviting so you’re able to potential lenders and might help you safe a lower home loan interest rate. In this action, you could look at the credit file to own errors, settle any a good expense, and build a reputation in control borrowing from the bank incorporate.

Step 5: Score financial preapproval

After you’ve acquired courtroom approval and you may handled your creditworthiness, it is time to find preapproval having a mortgage. This involves providing a potential bank with economic pointers, like your money, discounts, and you will assets.

The lending company will then make you a page saying how much they are happy to provide you. It preapproval page can provide a crisper idea of exactly what belongings you really can afford and will make you more desirable to vendors.

Along with your preapproval letter at your fingertips, you can begin your house browse. Always think all expenses associated with homeownership, not just the cost. Including assets taxes, home insurance, and you can restoration will set you back. It’s also smart to think about your upcoming needs and you may lifetime when choosing property.

After you have located property that meets your needs and you can fits within your budget, you possibly can make a deal. In the event the vendor welcomes your bring, you are able to transfer to the newest closing procedure, which has finalizing your financial, performing property evaluation, and you will finalizing all of the called for documents.

Action eight: Romantic on your own brand new home

After all the paperwork is actually finalized additionally the home loan is actually signed, you might close in your brand new home. This is the finally step up the home buying processes and you may marks the beginning of the journey since the a homeowner. Enjoy that it high achievement!

To get a home while in Chapter thirteen personal bankruptcy need mindful planning, persistence, and the best recommendations. However with an obvious understanding of the method and you may a partnership to economic obligation, its yes attainable.

Ideas to qualify for home financing having Part 13 case of bankruptcy

Merely conference the fresh 12-week dependence on a federal government loan will not guarantee you’ll be able to meet the requirements. But here are some tips to improve your chances of financial acceptance immediately after a part thirteen bankruptcy proceeding filing:

- Re-expose their good credit. Make a plan to create the new borrowing from the bank if you are paying down bills and you may and then make on the-day money for utilities, playing cards, and you can auto loans

- See fundamental credit advice. These are typically requirements to possess credit history, money, work, and you will down-payment, on top of other things. Which have a stable earnings and lots of coupons could help qualify when you have earlier in the day credit points

- Also have extra files due to your Chapter thirteen. Lenders will likely want copies of your case of bankruptcy petition and you can discharge otherwise dismissal documents

- Make certain that you allocated accurately for brand new loans. Just remember that , their homeloan payment ought to include taxes and you will insurance coverage once the well just like the financing dominating and you may attention. If you place below 20% down, it will become individual home loan insurance otherwise FHA mortgage insurance coverage. Such added costs increases property fee significantly

Before you plunge on the software procedure, set aside a bit to consider the limit budget for costs and exactly how the cost of homeownership have a tendency to fit in with your debt repayment plan.

Working with bankruptcy attorney

When trying to acquire property whilst in Part 13 personal bankruptcy, hiring a personal bankruptcy attorneys can be hugely of good use. An attorney with bankruptcy proceeding sense can offer priceless recommendations, help you in navigating the tough courtroom processes, and help you earn courtroom approval no credit check payday loans in Newville.

Step four: Improve your borrowing

When you’re their motion has been processed, make use of this for you personally to focus on improving your credit rating. That it requires settling all of your current bills on time and you can refraining regarding using up any extra financial obligation. A high credit rating can make you more inviting so you’re able to potential lenders and might help you safe a lower home loan interest rate. In this action, you could look at the credit file to own errors, settle any a good expense, and build a reputation in control borrowing from the bank incorporate.

Step 5: Score financial preapproval

After you’ve acquired courtroom approval and you may handled your creditworthiness, it is time to find preapproval having a mortgage. This involves providing a potential bank with economic pointers, like your money, discounts, and you will assets.

The lending company will then make you a page saying how much they are happy to provide you. It preapproval page can provide a crisper idea of exactly what belongings you really can afford and will make you more desirable to vendors.

Along with your preapproval letter at your fingertips, you can begin your house browse. Always think all expenses associated with homeownership, not just the cost. Including assets taxes, home insurance, and you can restoration will set you back. It’s also smart to think about your upcoming needs and you may lifetime when choosing property.

After you have located property that meets your needs and you can fits within your budget, you possibly can make a deal. In the event the vendor welcomes your bring, you are able to transfer to the newest closing procedure, which has finalizing your financial, performing property evaluation, and you will finalizing all of the called for documents.

Action eight: Romantic on your own brand new home

After all the paperwork is actually finalized additionally the home loan is actually signed, you might close in your brand new home. This is the finally step up the home buying processes and you may marks the beginning of the journey since the a homeowner. Enjoy that it high achievement!

To get a home while in Chapter thirteen personal bankruptcy need mindful planning, persistence, and the best recommendations. However with an obvious understanding of the method and you may a partnership to economic obligation, its yes attainable.

Ideas to qualify for home financing having Part 13 case of bankruptcy

Merely conference the fresh 12-week dependence on a federal government loan will not guarantee you’ll be able to meet the requirements. But here are some tips to improve your chances of financial acceptance immediately after a part thirteen bankruptcy proceeding filing:

- Re-expose their good credit. Make a plan to create the new borrowing from the bank if you are paying down bills and you may and then make on the-day money for utilities, playing cards, and you can auto loans

- See fundamental credit advice. These are typically requirements to possess credit history, money, work, and you will down-payment, on top of other things. Which have a stable earnings and lots of coupons could help qualify when you have earlier in the day credit points

- Also have extra files due to your Chapter thirteen. Lenders will likely want copies of your case of bankruptcy petition and you can discharge otherwise dismissal documents

- Make certain that you allocated accurately for brand new loans. Just remember that , their homeloan payment ought to include taxes and you will insurance coverage once the well just like the financing dominating and you may attention. If you place below 20% down, it will become individual home loan insurance otherwise FHA mortgage insurance coverage. Such added costs increases property fee significantly

Before you plunge on the software procedure, set aside a bit to consider the limit budget for costs and exactly how the cost of homeownership have a tendency to fit in with your debt repayment plan.

Working with bankruptcy attorney

When trying to acquire property whilst in Part 13 personal bankruptcy, hiring a personal bankruptcy attorneys can be hugely of good use. An attorney with bankruptcy proceeding sense can offer priceless recommendations, help you in navigating the tough courtroom processes, and help you earn courtroom approval no credit check payday loans in Newville.